You can choose to work in academia, public accounting, or in private industry. To become a Texas CPA, you must have a solid education and meet state requirements. You must pass the Uniform CPA Exam to become a Texas CPA. This exam is administered by the National Association of State Boards of Accountancy.

You must complete minimum education requirements and pass the rigorous CPA exam to become a Texas Certified Public Accountant. CPA requirements for Texas include 150 semester hours. You must also take an ethics course approved by the TSBPA. This course must also be completed prior to the submission of your final application for a CPA Certificate.

CPA requirements in Texas are different than those in other states. Applicants in Texas do not have to be in-state residents. However, aspiring CPAs must take the Uniform CPA Exam, and a national fingerprint background check is required. A state board must receive an Application of Intent form from anyone with a criminal record.

After you submit the Application of Intent, a notice will be sent to you to schedule your Uniform CPA Examination. The application fee is $50 and the reexamination fee of $60 will be due. Upon completing the exam, you will be mailed a license application packet. You must complete this package within the 90-day period following your application. A work experience form will be sent to you. The CPA will direct you through the completion of 2,000 hours worth of work experience. You can do the hours part-time, for as long as you like.

CPA Texas requirements require that you complete 120 hours of continuing professional education (CPE), within any three-year reporting period. You can earn CPE credit through advanced course teaching or attending conferences. CPE credit must be earned through approved CE sponsors. You must also keep documentation of the CE hours you have completed for five years.

Texas CPA requirements also require passing the Texas Rules of Professional Conduct. This exam is open-book and can be taken online. You can retake the exam within two days if you fail to pass the initial attempt. To earn your certificate, you must score 85%. Also, you must submit a notarized swearing of office, in which you promise to uphold Texas' laws. You must have a public official notarize your oath.

To be eligible to take the Uniform CPA Exam in Texas, you must have a bachelor's degree from an accredited college. You will need to complete 150 semester hours. This includes 24 credits in business and accounting. You must also complete a 4-hour board-approved ethics course. To be eligible for the Uniform CPA examination, you will also need to pass Texas Rules of Professional Conduct.

FAQ

What is a Certified Public Accountant and how do they work?

A C.P.A. certified public accountant is a person who has been certified in public accounting. An accountant is someone who has special knowledge in accounting. He/she is able to prepare tax returns and help businesses make sound business decisions.

He/She also tracks cash flow and makes sure that the company runs smoothly.

How long does it take for an accountant to become one?

The CPA exam is necessary to become an accountant. The average person who wants to become an accountant studies for approximately 4 years before sitting for the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

What is bookkeeping exactly?

Bookkeeping refers to the process of keeping financial records for individuals, companies, or organizations. This includes all income and expenses related to business.

All financial information is kept track by bookkeepers. These include receipts. Invoices. Bills. Payments. Deposits. Interest earned on investments. They also prepare tax returns and other reports.

Accounting: Why is it useful for small-business owners?

Accounting is not only useful for big businesses. It's also useful for small business owners because it helps them keep track of all the money they make and spend.

If you run a small business, you likely know how much money comes in each month. But what happens if you don’t have a professional accountant to help you with this? You might find yourself wondering where you are spending your money. Or you could forget to pay bills on time, which would hurt your credit rating.

Accounting software makes keeping track of your finances easy. There are many options. Some are free; others cost hundreds or thousands of dollars.

You will need to learn the basic functions of every accounting system. It will save you time and help you understand how to use it.

These three tasks are essential.

-

Record transactions in the accounting system.

-

Keep track of income and expenses.

-

Prepare reports.

After you have mastered these three points, you can start to use your new accounting software.

What type of training is required to become a Bookkeeper?

Basic math skills such as addition and subtraction, multiplication or division, fractions/percentages, simple algebra, and multiplication are essential for bookkeepers.

They need to also be able and confident in using a computer.

Most bookkeepers have a high school diploma. Some have even earned college degrees.

Why is reconciliation important

It's important, as mistakes are possible at any moment. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can lead to serious consequences like inaccurate financial statements and missed deadlines, excessive spending, bankruptcy, and other negative effects.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

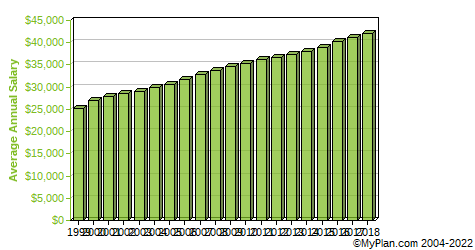

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to Become a Accountant

Accounting is the science behind recording transactions and analysing financial data. It involves the preparation and maintenance of various reports and statements.

A Certified Public Accountant, also known as a CPA, is someone who has successfully passed the CPA exam. They are licensed by the state's board of accountancy.

An Accredited Financial Advisor (AFA), is an individual that meets certain criteria established by American Association of Individual Investors. A minimum of five year's investment experience is required before an individual can be made an AFA. They must pass a series exam to verify their understanding of accounting principles.

A Chartered Professional Accountant, also known as a chartered accountant or chartered accountant, a professional accountant who holds a degree from a recognized university. CPAs must meet specific educational standards established by the Institute of Chartered Accountants of England & Wales (ICAEW).

A Certified Management Accountant, also known as a CMA, is a certified professional who specializes on management accounting. CMAs must pass the ICAEW exams and continue their education throughout their careers.

A Certified General Accountant (CGA), member of the American Institute of Certified Public Accountants. CGAs are required to take several tests; one of these tests is known as the Uniform Certification Examination (UCE).

International Society of Cost Estimators, (ISCES), offers the Certified Information Systems Auditor (CIA), a certification. CIA candidates must complete three levels of study consisting of coursework, practical training, and a final examination.

Accredited Corporate Compliance Office (ACCO), a designation conferred by the ACCO Foundation as well as the International Organization of Securities Commissions. ACOs are required to hold a baccalaureate degree in finance, business administration, economics, or public policy and must pass two written exams and one oral exam.

A Certified Fraud Examiner (CFE) is a credential by the National Association of State Boards of Accountancy (NASBA). Candidates must pass at least three exams to be certified fraud examiners (CFE).

International Federation of Accountants is accredited a Certified Internal Audior (CIA). Candidates must pass four exams covering topics such as auditing, risk assessment, fraud prevention, ethics, and compliance.

American Academy of Forensic Sciences (AAFS) designates an Associate in Forensic Account (AFE). AFEs should have a bachelor's degree from an accredited college, university or other educational institution in any area of study.

What does an auditor do? Auditors are professionals who conduct audits of organizations' internal controls over financial reporting. Audits can be conducted randomly or based upon complaints from regulators regarding the organization's financial reports.