Bench Bookkeeping offers specialized bookkeeping services. They are quicker than traditional accounting software and less expensive than having someone else keep your books. However, some users have complained that turnaround time for catching up on books is longer than expected. Despite this, many Bench users praise the knowledge of their staff and excellent customer service. Bench's helps business owners focus on running their businesses and not on managing their books.

Bench bookkeeping can be used for specialized bookkeeping

Bench bookkeeping offers specialized bookkeeping service. A team of three bookkeepers will handle all your bookkeeping needs. The team is led by a senior accountant who reviews your financial packages and monthly statements. You can also get answers from small business experts. They offer regular updates and an app through which you can book a meeting with your bookkeeper any time.

Bench's monthly services start at $100 These packages include specialized bookskeeping and tax preparation. Both plans offer the same level bookkeeping but Bench offers additional services. The team is comprised of professional bookkeepers, who are not licensed to give tax or financial advice.

It's quicker than accounting software

Bench bookkeeping is a great choice for small businesses who don't have the time to spend balancing the books. Although the program is able to perform basic bookkeeping tasks and provide tax services, more advanced accounting software and services may be required by businesses. It also doesn't offer inventory management or invoicing capabilities.

Bench is very easy to use and users are generally happy with the results. Some people complained that their books took longer than they expected. Although they were told it would take 2 to 3 weeks for the books to be ready, they discovered that it took much longer. Other users were satisfied with the level and quality of customer support they received. Bench has another advantage: they don't need to manage their own bookkeeping, saving them valuable time.

It's less expensive than paying for bookkeeping service

Bench is an excellent choice if you're looking for a cost-effective way to manage your bookkeeping. Bookkeeping online is less expensive than hiring an individual bookkeeper. Bench also charges no support fees. You may still need some assistance, such as with reconciling your bank accounts.

The service connects to your bank, merchant processor, and credit card company. You can also take photos of cash receipts to send to your bookkeeper. They will categorize the transactions and help you understand your business better. Bench has a team that can work around your schedule. They can complete the bookkeeping process for you in 2 to 4 weeks.

It's not compatible with Quickbooks

Bench is an excellent alternative to Quickbooks. It is a proprietary software program that handles your bookkeeping. This makes it incompatible with other online bookkeeping software. This can make it difficult for users to switch between the programs. Additionally, you may need to spend extra time or hire a service to do this manually. Bench's most important advantage is its support team. The company assigns each customer a team of three bookkeepers, one of whom will serve as your account manager.

Quickbooks has a configurable dashboard. Bench however isn't as flexible as its rival. It lacks an API which makes it difficult to integrate with other software like QuickBooks. It also does not provide information on job costs. This is essential if you want track customer costs and profitability.

It doesn’t offer invoice

Bench bookkeeping doesn't offer invoicing, which means that you'll need to use an external system for billing. There are several options available to import your financials. For instance, you can use apps like PayPal and Gusto to import statements. You can also upload your statements to Bench manually.

Bench can generate accruals by using a modified cash basis. In short, the bookkeeper records transactions when money is deposited into an account. Unlike many other bookkeeping software, Bench doesn't offer invoicing or bill tracking. Third-party systems can help you with this.

FAQ

What does an auditor do?

An auditor looks for inconsistencies between the information given in the financial statements and the actual events.

He verifies the accuracy of all figures supplied by the company.

He also confirms the accuracy of the financial statements.

What training is needed to become an accountant?

Basic math skills are required for bookkeepers. These include addition, subtraction and multiplication, divisions, fractions, percentages and simple algebra.

They should also know how to use computers.

Many bookkeepers are graduates of high school. Some even have college degrees.

Are accountants paid?

Yes, accountants often get paid hourly.

Complicated financial statements can be a charge for some accountants.

Sometimes accountants are hired to perform specific tasks. For example, a public relations firm might hire an accountant to prepare a report showing how well their client is doing.

What is an accountant and why are they so important?

An accountant keeps track all the money that you earn and spend. They keep track of how much tax is paid and allowable deductions.

An accountant can help you manage your finances and keep track of your incomes and expenses.

They help prepare financial reports for businesses and individuals.

Accountants are essential because they need to understand everything about numbers.

In addition, accountants help people file taxes and ensure they're paying as little tax as possible.

What should I do when hiring an accountant?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You need someone who is experienced in this type of work and can explain the steps.

Ask them if they have any knowledge or skills that might be useful to you.

Be sure to establish a good reputation within the community.

What's the difference between a CPA or Chartered Accountant?

Chartered accountants are professional accountants who have passed the required exams to earn the designation. Chartered accountants usually have more experience than CPAs.

Chartered accountants are also qualified to offer tax advice.

The course of chartered accountantancy takes approximately 6 years.

How can I tell if my company has a need for an accountant?

Many companies hire accountants after reaching certain levels. A company might need an accountant when it makes $10 million annually or more in sales.

However, not all companies need accountants. This includes small businesses, sole proprietorships and partnerships as well as corporations.

It doesn't matter what size a company has. The only thing that matters is whether the company uses accounting systems.

If it does then the company requires an accountant. A different scenario is not possible.

Statistics

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

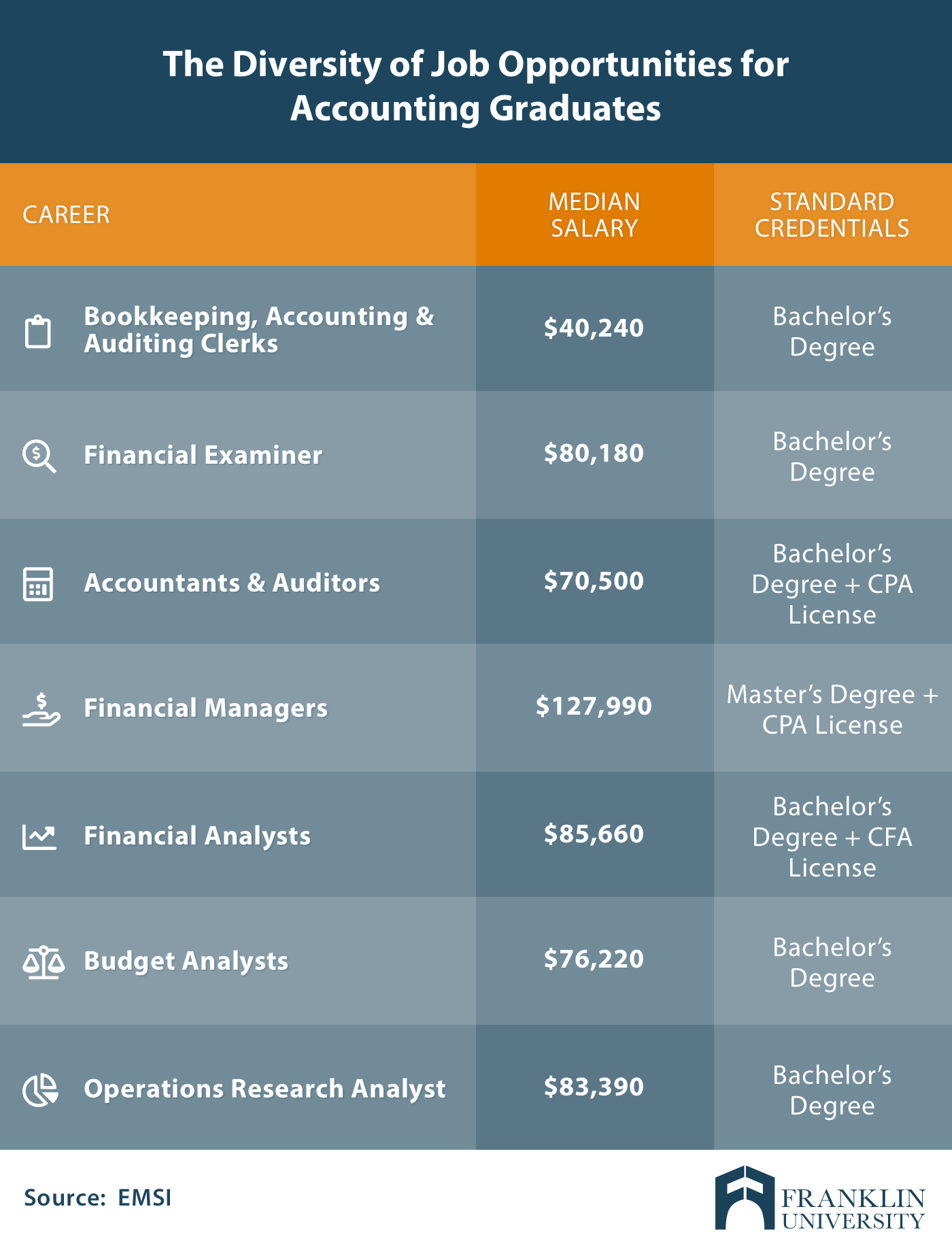

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

Accounting The Best Way

Accounting is a collection of processes and procedures that businesses use to record and track transactions. It includes recording income, expense, keeping records sales revenue and expenditures as well as creating financial statements and analyzing data.

It also includes reporting financial information to stakeholders like shareholders, lenders and investors, customers and customers, etc.

Accounting can be done in many different ways. Some include:

-

Creating spreadsheets manually.

-

Excel can be used.

-

Notes on paper for handwriting

-

Computerized accounting systems.

-

Online accounting services.

Accounting can be done many ways. Each method comes with its own set of advantages and disadvantages. Which one you choose depends on your business model and needs. Before you decide to use any of these methods, make sure you consider their pros and cons.

Accounting methods can be efficient for many reasons. If you're self-employed, for example, it might be a good idea to keep accurate books as they can provide proof of your work. Simple accounting techniques may work best for small businesses, especially if they don't have much money. If your business is large and generates large amounts cash, it might be a good idea to use more complex accounting methods.