If you're considering a career in accounting you might be curious as to what jobs there are. Here are some examples of different accounting careers. These include their job descriptions and education requirements. You can also see their career outlook. You can also start your own accounting firm and chart the financial course of your clients. Whatever your choice, an accounting degree can help you maximize your potential.

Descriptions of job

If you have an Accounting degree, you are well-positioned for an array of exciting career opportunities. Accountants are required in all business sectors. However, they also have strong analytical skills that allow them to see long-term company goals and develop strategies to meet them. These are just a few of the many types of jobs available to graduates. Find out more about the accounting jobs in the United States.

An accountant is employed by a company or firm but can also work independently. They use their financial knowledge to assist businesses with important accounting tasks. These include analyzing company finances, monitoring and reviewing budgets, calculating employee paychecks, and determining tax obligations. An accountant job description should outline the position and the company as well highlight the company's culture. This information can be used to help potential candidates make a decision about their career.

There are many career options

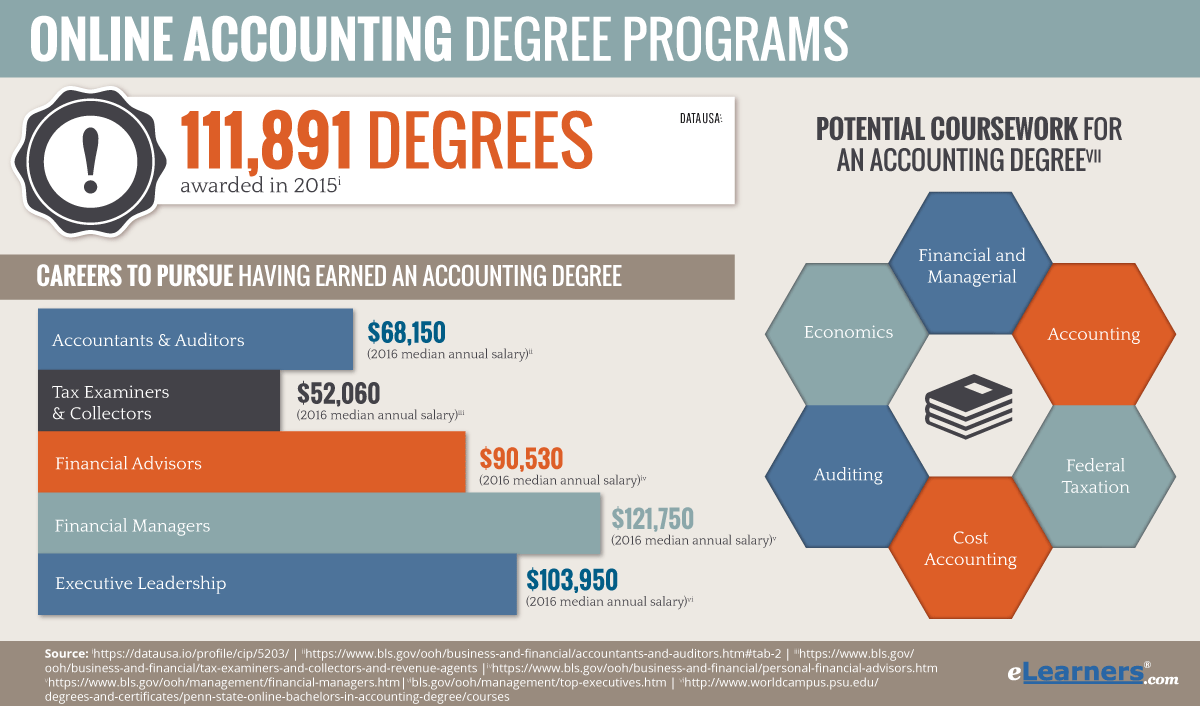

A bachelor's degree with an accounting concentration allows you to pursue a career in any industry from business to government. Accounting degrees can lead to many opportunities and offer financial rewards. An average salary for an accountant is $129,890. A bachelor's degree in accounting can also help you advance your education or pursue your own interests.

A master's degree in accounting allows you to specialize in a particular field of accounting, like taxation, forensics, or auditing. It also gives you the opportunity to focus on your soft skills, which can be beneficial in many industries. A master's degree can lead to many different career opportunities. After earning your degree, you'll be prepared for a variety of roles, including managerial and executive positions.

Education Required

There are many careers in the accounting industry. Graduates with a bachelor's degree in accounting will have a broad base of knowledge in accounting principles and practices. Advanced accounting courses include topics such as fraud examination, auditing and international business. This degree prepares you for leadership positions in organisations. Accounting skills are highly demanded in today's global economic environment. Below are some of the most popular accounting-related positions.

Accounting entry-level jobs usually require a minimum of a bachelor’s degree. However some job openings may require an Associate’s Degree. Accounting programs often include coursework in accounting management, economics and ethics. Internships can be offered to students who want to gain real-world experiences. Graduate students might be eligible for academic professorships or clerical work depending on their level of education.

Career outlook

Accountants have a bright future, but it's important that you keep in mind the fact that the field is on the rise. According to the U.S. Bureau of Labor Statistics (USBLS), accountant job opportunities will rise by 6 percent between 2018-2028. The accounting field is in high demand by businesses but there are also more accountants needed in other fields. MoneyWise says that accountant and auditor jobs are among the nation's fastest growing, with more 139,000 openings expected in the next seven years.

When considering a career in accounting, prospective students should learn about the job outlook before investing in an advanced degree. It is crucial to investigate job prospects, expected growth, salaries, and the responsibilities in different roles. By doing this, students will be better prepared to transition into a new career after graduation. Accounting students will find many rewarding job roles after graduating from an accounting degree program.

FAQ

What are the benefits of accounting and bookkeeping?

Accounting and bookkeeping are essential for every business. They allow you to keep track of all transactions and expenses.

These items will also ensure that you don't spend too much on unnecessary items.

You should know how much profit your sales have brought in. Also, you will need to know how much debt you owe other people.

If you don’t have enough money, you might think about raising the prices. If you raise them too high, though, you might lose customers.

You may be able to sell some inventory if you have more than what you need.

If you have less than you need, you could cut back on certain services or products.

All these things will have an impact on your bottom-line.

What is bookkeeping?

Bookkeeping can be described as the keeping of records about financial transactions for individuals, businesses and organizations. It involves recording all business-related income as well as expenses.

Bookkeepers maintain financial records such as receipts. They also prepare tax reports and other reports.

What is the purpose accounting?

Accounting gives a snapshot of financial performance through the recording, analysis, reporting, and recording of transactions between parties. Accounting allows organizations make informed decisions about how much money to invest, how likely they are to earn from their operations, and whether or not they need to raise additional capital.

Accountants record transactions in order to provide information about financial activities.

The data collected allows the organization to plan its future business strategy and budget.

It is crucial that the data are accurate and reliable.

What should I expect when hiring an accountant?

Ask questions about their experience, qualifications, references, and other relevant information when hiring an accountant.

You need someone who has done it before and is familiar with the process.

Ask them if you could benefit from their special skills and knowledge.

Make sure they have a good name in the community.

What is the best way to keep books?

For you to begin keeping your books, you'll need a few things. These include a notebook, pencils, calculator, printer, stapler, envelopes, stamps, and a filing cabinet or desk drawer.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

How to do Bookkeeping

There are many types of accounting software available today. There are many types of accounting software available today. Some are free while others cost money. However, they all offer basic features like invoicing and billing, inventory management as well as payroll processing, point of sale systems and financial reporting. The following is a brief overview of the most widely used types of accounting software.

Free Accounting Software: Most accounting software is free and available for personal use. Although the software may be limited in functionality, such as not being able to create your own reports, it is very easy to use. A lot of free programs can be used to download data directly to spreadsheets. This makes them very useful for anyone who wants to do their own analysis.

Paid Accounting Software: These accounts are for businesses that have multiple employees. They typically include powerful tools for managing employee records, tracking sales and expenses, generating reports, and automating processes. Although most paid programs require a minimum of one year to subscribe, there are many companies that offer subscriptions for as little as six months.

Cloud Accounting Software: You can access your files from anywhere online using cloud accounting software. This program is becoming increasingly popular due to its ability to save space on your computer hard drives, reduce clutter, and make remote work easier. There is no need to install any additional software. You only need an internet connection and a device that can access cloud storage services.

Desktop Accounting Software: Desktop software works in a similar way to cloud accounting software. However, it runs locally on your own computer. Desktop software is similar to cloud software. You can access your files from anywhere you want, even through mobile devices. You will need to install the software on your PC before you can use it, however, unlike cloud software.

Mobile Accounting Software is designed to run on smaller devices, such as tablets and smartphones. These programs enable you to manage your finances even while you're on the move. They offer fewer functions than desktop programs, but are still useful for those who travel a lot or run errands.

Online Accounting Software is specifically designed for small businesses. It contains all the functions of a traditional desktop application, as well as some additional features. One advantage of online software is that it requires no installation; simply log onto the site and start using the program. You can also save money and avoid the overheads of a local office.